Bulk Dispositions

If the sale of a group of assets is to be reported on Form 4797, Sales of Business Property or Form 6252, Installment Sale Income, use the Bulk Sales feature to link the assets together into one sale with one sale price.

The Fixed Assets form will calculate the gain/loss for a group of assets tied together in one sale using the Bulk Sales feature. In the Fixed Assets form, there are two types of Bulk Dispositions available: Sale/Abandonment and Installment sales.

Be sure to review the IRS reporting requirements and explanation of how to treat different classes of assets if grouping assets together in a sale. (Publication 544, Sales and Other Dispositions of Assets)

Assets grouped in a bulk sale should be of the same property type, for example, all the assets are Section 1245 property (depreciable personal property tangible or intangible) or Section 1250 property (real property).

To add a new Bulk Disposition:

- In the navigation pane, select one of the assets to be included in the Bulk Disposition.

- Click the Dispositions tab and select Sale/abandonment or Installment sale from the drop-down.

- Select the Bulk Disposition check box, and then select Add New from the drop-down list.

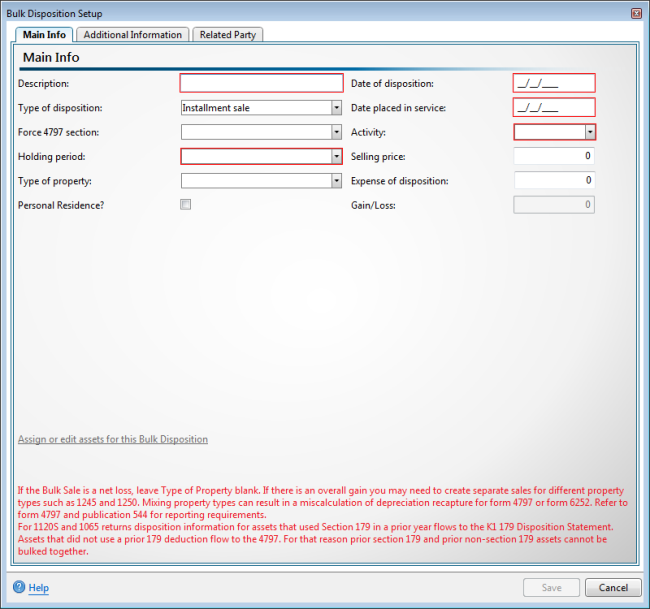

Bulk Dispositions Setup dialog box

- Enter a Description for the bulk disposition.

- Enter the Date of disposition.

- Select the Type of disposition from the drop-down list the .

- Enter the Date placed in service.

Leave VARIOUS as the entry if the assets where placed in service on different dates.

- To Force 4797 section, make a selection from the drop-down list.

- Select the Activity from the drop-down list.

- Select the Holding period from the drop-down list.

- Enter the Selling price of the assets in the Bulk Sale.

- Select the Type of property from the drop-down list.

- Enter any incurred Expense of disposition.

- Click Assign or edit assets for this Bulk Disposition.

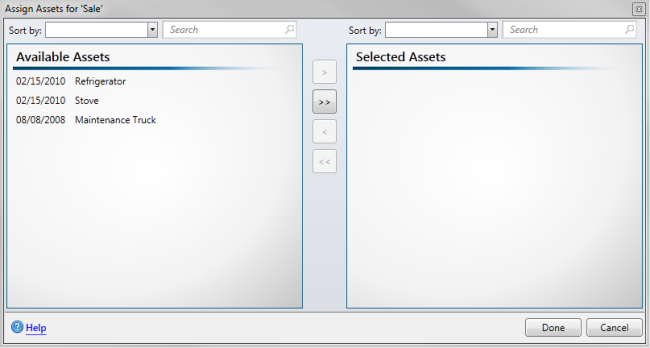

Assign Assets dialog box

Assets already assigned to other dispositions will not be available for assignment to the Bulk Disposition.

Only assets assigned to the same activity as the current selected asset will be available for assignment to the Bulk Disposition.

- Select the assets to be included in the bulk sale from the Available Assets column and move them to the Selected Assets column by clicking > for each or >> to move all.

To select multiple assets at once, hold the Ctrl key and select the assets with your mouse.

- Click Done.

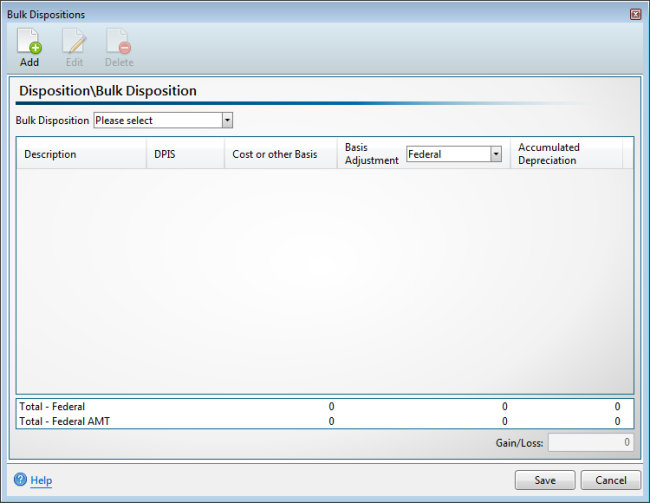

Bulk Dispositions dialog box (blank)

- Click Save.

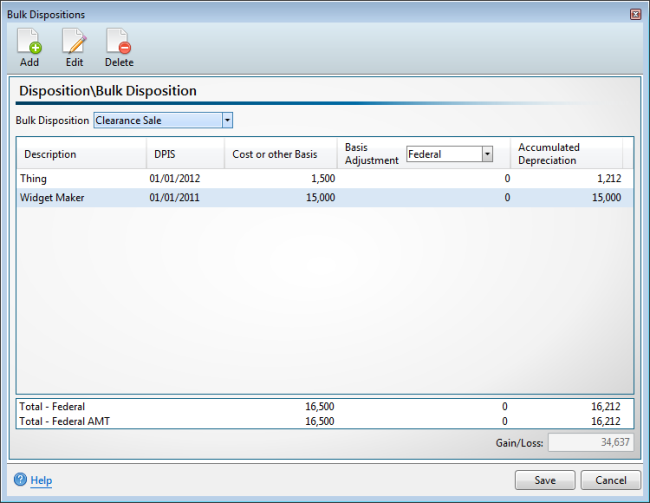

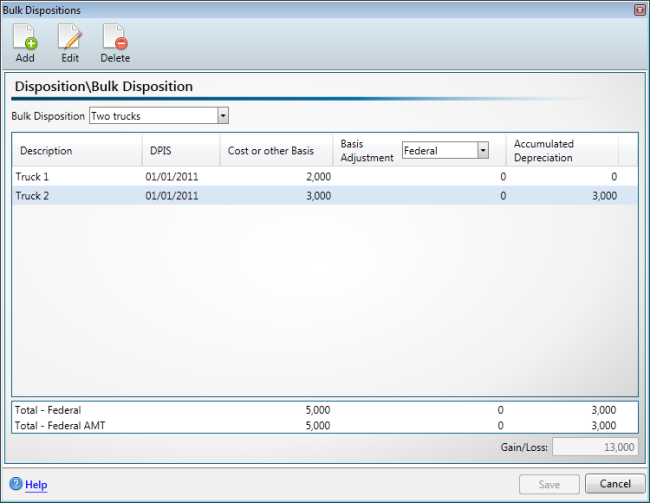

- Select the unique identifier for the desired Bulk Disposition from the Bulk Disposition drop down list.

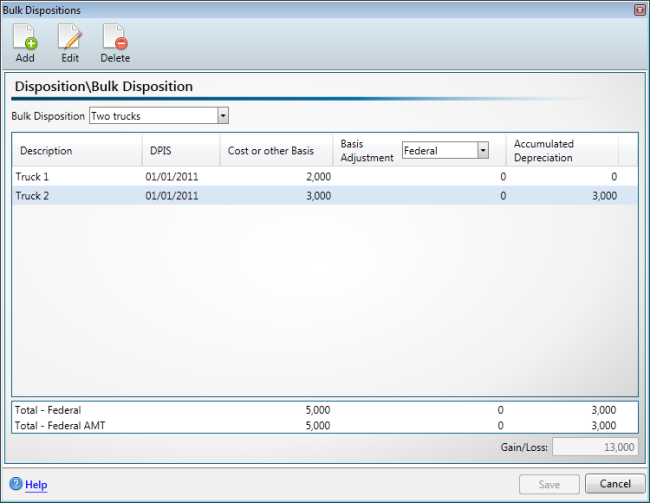

The details of each asset's disposition and the totals for all assets in the bulk disposition are displayed in the Bulk Dispositions dialog box and Gain/Loss is calculated based on the total sale.

Click the Edit button to return to the Bulk Disposition Setup dialog box if you need to edit the details of the disposition.

- Click Save.

To edit an existing Bulk Disposition:

- In the Navigation pane, select one of the assets that currently belongs to the Bulk Disposition to be edited.

- From the Dispositions tab, select the bulk disposition from the drop-down list, and then click View Bulk Disposition.

Bulk Dispositions dialog box (populated)

- Click the Edit button on the toolbar.

Bulk Disposition Setup dialog box

- Edit the details of the selected Bulk Disposition as desired.

To add assets to the selected bulk sale, click the Assign or edit assets for this Bulk Disposition link and refer to steps 14 - 16 above.

- Click Save to save your changes or click Cancel to exit without saving.

To delete an existing bulk disposition:

- In the Navigation pane, select one of the assets belonging to the desired Bulk Disposition.

- From the Dispositions tab, select the bulk disposition from the drop-down list, and then click View Bulk Disposition.

Bulk Dispositions dialog box (populated)

- Click the Delete button on the toolbar.

- Click Yes to delete or click No to cancel the operation and return to the Bulk Dispositions dialog box.

For any bulk disposition that includes the sale of a personal residence, the Sale of Personal Residence Worksheet in Form 8949 must also be completed.

See Also: